Why do you require PAN Card Verification?

-

Loan/Credit Card Fraud: Misuse of stolen PAN for applications.

Loan/Credit Card Fraud: Misuse of stolen PAN for applications.

Forgery: Creation of fake/altered PAN cards.

Forgery: Creation of fake/altered PAN cards. Identity Theft: Stealing PAN for fraudulent transactions and impersonation.

Identity Theft: Stealing PAN for fraudulent transactions and impersonation.

Why Choose

DIGIPE Surefy?

Enhanced Security

Industry-leading security protocols protect sensitive data.

Real-Time Results

Get instant verification decisions without delays.

Global Coverage

Access a vast network of trusted data sources worldwide.

Easy Integration

Our APIs integrate seamlessly with your existing systems.

Scalable Solutions

Accommodate your growing verification needs effortlessly.

Dedicated Manager

Your business is our focus. Dedicated relationship Manager understand your business needs & helps you unlock opportunities.

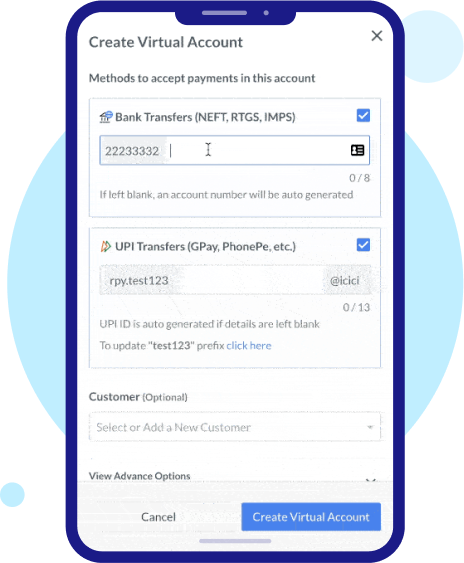

Application of Razorpay SmartCollect Across Industries

How are companies like you using Razorpay

SmartCollect for reconciliation

Challenge

Innov8 is a co-working space with multiple offices and branches across India. Some of Innov8’s customers prefer paying directly to the bank account. Reconciling these payments is a cumbersome task.

Solution

With Smart Collect, Innov8 creates, assigns and shares a unique VA and VPA to each customer. With this they have saved 60+ man hours every month, can send automatic payment notification to every customer and save on the payment commission charges.

Frequently Asked Questions

Discover the versatility of account verification in various business contexts:

Streamlining Employee Background Checks: Recruitment agencies can utilize this feature to conduct thorough background verifications on potential candidates.

Facilitating Vendor Onboarding: Marketplaces engaging with multiple vendors can employ this feature to authenticate bank accounts, PAN, or other details during onboarding. This ensures precise payments and integrates seamlessly with existing ERP systems, reducing operational burdens and expenses.